Atlantic City Casinos In Danger Of Closing Says NJ’s Top Lawmaker

The economic reality of Atlantic City casinos was laid bare during a New Jersey Senate committee hearing Monday.

Outgoing Senate President Steve Sweeney warned Budget & Appropriations Committee members that without changes to the current law governing Atlantic City casinos’ property tax payments, a handful of the city’s nine gambling parlors could shut down.

“We’re at risk of four casinos closing,” Sweeney said.

On Monday, the committee voted in favor of S4007, a bill amending the 10-year payment-in-lieu-of-taxes, or PILOT, law for Atlantic City casinos. The proposal would recalibrate the payment structures for the nine Atlantic City casinos over the next five years to more accurately reflect the current gaming market.

“We made some mistakes in the (2016) PILOT bill,” Sweeney, the sponsor of the original law and the new amendments, said during Monday’s hearing. “If we don’t fix them, we run the risk of closing four casinos.”

Did Atlantic City casinos make a ‘bad bet’ in 2016?

Atlantic City casinos are on pace to pay approximately $152.6 million in 2021 based on the current PILOT, according to data obtained by Play NJ. The Office of Legislative Services estimates the casinos could pay as much as $209.6 million in 2022 under the current PILOT.

Should S4007 become law, the projected payment for next year is $154.6 million.

The difference of $55 million in estimated tax revenue to Atlantic City, Atlantic County and the city school district is concerning to some local officials.

Former Atlantic City Mayor and state Assemblyman-elect Don Guardian testified Monday against changing the law.

“The gaming industry decided to gamble,” in 2016 when the casinos agreed to the terms of the original PILOT, Guardian said. “Now, we know it was a bad bet. But we shouldn’t be paying for that bad bet.”

Small, Perskie say PILOT changes will not hurt Atlantic City

Atlantic City Mayor Marty Small Sr. supports the PILOT amendments.

During a recent press conference, Small said the city was in a better financial position today than five years ago and will be better five years from now.

“And that is because of the PILOT bill,” he said, adding the reason he supports the amendments is, “quite frankly, the City of Atlantic City is guaranteed, under the different variables in the bill, to be in no worse position than any previous year.”

Small’s advisor, former Superior Court Judge Steven Perskie, drafted the legislation that became the Casino Control Act as an assemblyman in the 1970s.

“Under the revised formula (Atlantic City casinos) will collectively pay more in 2022 than in 2021, and more in 2023 than in 2022,” Perskie said.

Atlantic County’s top elected official vows to ‘fight’

Small and Perskie emphasized they were only speaking to the bill’s impact on Atlantic City.

Atlantic County has a court-ordered settlement as a result of the PILOT.

Atlantic County Executive Dennis Levinson told The Press of Atlantic City the changes violate that court order.

“I am prepared to fight this bill, along with (state Sen. Vince) Polistina,” Levinson said.

Hold-harmless provisions in state law protect New Jersey school districts to prevent drastic declines in tax revenue. Thus far, the Atlantic City school district has made no public comment on the proposed PILOT changes.

Why do Atlantic City casinos not pay property taxes like everyone else?

So, what changes are being proposed, where do all these numbers come from and why is this happening now?

Before answering those questions, it’s important to understand how the PILOT came to be in the first place.

The intent of the 2016 PILOT was to stabilize Atlantic City’s finances by eliminating costly property tax appeals by the casinos. The 10-year deal guaranteed the city, county and school district a reliable revenue source tied to the financial performance of the casinos.

At the time, both the city and casinos were reeling in the wake of a one-two economic punch from the Great Recession and the legalization of gambling in Pennsylvania.

Five casinos closed between 2014 and 2016. Tens of thousands of local jobs were lost. Atlantic County led the nation in foreclosures.

The State of New Jersey seized control of the city’s financial-making decisions in November 2016.

What’s changed in Atlantic City from five years ago?

The Atlantic City gaming market looked very different in 2016 than it does today.

The surviving seven casinos generated less than 50% of the $5.2 billion reported in 2006.

Online gambling accounted for 7.5% of the industry’s annual gross gaming revenue.

NJ sports betting was not yet legalized.

Two years later, the market started growing.

Hard Rock Hotel & Casino Atlantic City and Ocean Casino Resort opened on the Boardwalk.

Retail and online sports betting was available for the second half of 2018.

Online gambling was responsible for 10.3% of the $2.9 billion in gross gaming revenue.

By 2019, the Atlantic City market was as healthy as it had been in over a decade, reporting $3.29 billion. Likewise, Atlantic City (under state supervision) improved its overall financial position.

Just as things were looking up for the gritty city and its casinos, a global pandemic changed everything.

COVID sparks accelerated growth of online gambling

Atlantic City casinos were closed for more than 100 days in 2020 by order of Gov. Phil Murphy to mitigate the spread of COVID-19.

Online gambling continued unabated.

Unsurprisingly, online gambling revenues grew by leaps and bounds. Triple-digit percentage increases in year-over-year iGaming revenue became standard for most of 2020 and into 2021.

In 2020, online casino (not including online sports betting) generated $970.34 million and accounted for 36.6% of the industry’s $2.65 billion total.

Through October of this year, online gambling revenues are over $1.1 billion. That represents 31.9% of the industry’s total GGR in 2021.

Between 2013 and 2019, online gaming generated a combined total of $1.5 billion.

Online gambling is taxed at a higher rate than land-based revenue, so it’s a boon to state coffers.

However, most of the generated revenue goes to third-party online gaming operators, not the brick-and-mortar Atlantic City casinos.

Basics of the Atlantic City casino PILOT law

Here’s how the PILOT law works.

The PILOT outlines three distinct payment structures for Atlantic City casinos.

The first is an aggregate base payment.

The second comes from a set tax rate on retail (1.5%) and online (2.5%) gambling revenues called an investment alternative tax, or IAT.

The third, and largest, is a variable payment directly tied to gross gaming revenue (GGR), which is the sum of land-based, sports betting and online casino.

If the gaming industry does well, the payments increase and vice versa.

Take a look at the Atlantic City casino PILOT payments between 2017 and 2020 (base/IAT/variable):

- 2017: $148.8 million ($15M/$13.8M/$120M)

- 2018: $149.7 million ($10M/$9.7M/$130M)

- 2019: $151.4 million ($5M/$13.8M/$132.6M)

- 2020: $157.6 million ($5M/$0/$152.6M)

What the new PILOT bill would do

The proposed changes in S4007 would alter all three payment structures in the original PILOT.

The aggregate base payment is due to expire in 2023. The new bill extends those base payments for the life of the PILOT until 2026. Each year, the casinos would collectively pay $5 million.

IATs had been going to the state Casino Reinvestment Development Authority to pay bonds. The PILOT required they go toward paying down Atlantic City’s debt. A crediting mechanism in the law kept the payments at 2015 GGR levels, resulting in refunds to the casinos.

That crediting mechanism sunsets in 2021.

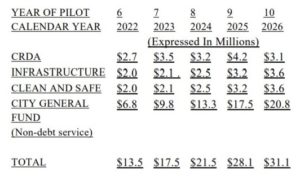

The proposed bill makes several changes to the uses of IATs, including creating a Clean and Safe Fund and Infrastructure Fund for Atlantic City. A revised draft of the bill also outlines a portion that goes back to the CRDA and Atlantic City’s general fund.

Saved the best for last

The final payment structure is the most complex.

Here’s how it works now.

Under the current PILOT, the variable payment made by the casinos is established by the industry’s annual GGR, which is defined as the sum of land-based, sports betting and online casino revenue.

The law outlines six tiers of GGR and correlating payment, of which each casino pays a percentage based on size and market share.

If the annual GGR does not move the payment amount to the next upward tier from one year to the next, the payment automatically increases by 2%.

Below are the GGR tiers and correlating payment in the current PILOT:

- $3.4 billion to $3.8 billion = $165 million

- $3B to $3.4B = $150M

- $2.6B to $3B = $130M

- $2.2B to $2.6B = $120M

- $1.8B to $2.2B = $110M

- Below $1.8B = $90M

How the variable PILOT would change

S4007 removes online casino and online sports betting from the GGR calculation.

For 2022, the bill sets the variable payment at $110 million.

A revised draft of the bill contains three GGR tiers — less than $2.3 billion, between $2.3 billion and $2.9 billion, and more than $2.9 billion.

The correlating payments are set at $100 million, $110 million and $120 million, respectively.

The 2% automatic increase now goes into effect if there is no upward or downward movement of GGR tiers.

For example, if the newly defined GGR is between $2.3 billion and $2.9 billion next year, the variable payment due in 2023 automatically increases to $112.2 million.

Why do Atlantic City casinos need help?

The proposed changes in S4007 also recalibrate how much each of the Atlantic City casinos will pay.

Some casinos will be paying more while others will pay less.

This market correction is necessary because of how much things have changed in Atlantic City since 2016. Quick refresher: two new casinos, sports betting legalized, online gambling revenue tripling as a percent of GGR, COVID shutdown.

Taken together, these variables have made the current situation unsustainable for a handful of Atlantic City casinos.

As Play NJ previously reported, monthly GGR and quarterly profit increases are not indicative of the market’s health.

Nearly every quantifiable metric for the industry within those reports is down, except online gaming revenue, sports betting revenue and average hotel room rate.

Labor levels and costs, promotional spending, general operating expenses, occupied room nights and land-based gaming revenues are all down in 2021 compared to pre-pandemic 2019.

Lame-duck session ends in January

The fate of S4007 now rests in the State Legislature‘s lame-duck session.

A companion version of the bill in the Assembly was introduced by Assemblyman John Armato, who also lost a reelection bid in November. Armato has since removed his name from the bill as a sponsor.

The Assembly bill, A5587, is slightly different from Sweeney’s Senate version. The Assembly Appropriations Committee will consider the bill on Monday.

Small said he expects the bill to pass before the current state legislative concludes on Jan. 11, 2022.

“If we don’t pass (the PILOT amendment bill), a financial analysis undertaken by the state…suggests the impact of the increases that take place in 2022 would put a significant portion of the industry in extreme financial distress,” Perskie said. “It’s too much, too soon.”

AP Photo/Wayne Parry