Barstool Sportsbook Quietly Rising In NJ Sports Betting Market

Barstool Sportsbook is a newbie to the New Jersey sports betting market, yet the typically brash and in-your-face brand is quietly settling in among the industry’s leaders.

Since launching in August, Barstool Sportsbook has joined the likes of FanDuel, DraftKings, BetMGM and Caesars as major players of NJ online sports betting.

Don’t believe it?

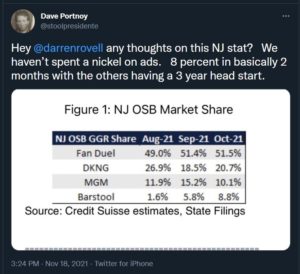

Here’s Dave Portnoy, founder of Barstool Sports, boasting of the sportsbook’s success in the Garden State while Twitter trolling The Action Network’s Darren Rovell.

There is just one small problem: the numbers are not entirely accurate.

“El Presidente” knows this (or at least someone with his professed financial acumen should).

The facts of NJ gambling revenue reporting

The market-share percentage Portnoy is pointing out reflects that of Barstool Sportsbook’s licensee, Freehold Raceway. Likewise with the numbers for FanDuel (Meadowlands Racetrack), DraftKings (Resorts Digital) and BetMGM (Borgata Hotel Casino & Spa).

Those figures are the total revenue of all online sports betting operators, or skins, under each New Jersey gaming licensee.

State gaming regulators do not break down monthly revenue by individual online operators, and that information is not publicly available.

October 2021 NJ sports betting revenue by license holder

| Licensee | Online Brand(s) | Total Revenue | Online Revenue | Retail Revenue | State Tax | Local Tax |

|---|---|---|---|---|---|---|

| Meadowlands | FanDuel | PointsBet | SuperBook | $44,099,790 | $39,593,964 | $4,505,826 | $5,534,188 | $1,046,932 |

| Resorts | DraftKings | Fox Bet | Resorts | $15,990,695 | $15,924,149 | $66,546 | $2,075,795 | $398,936 |

| Borgata | BetMGM | Borgata | $8,012,702 | $7,768,933 | $243,769 | $1,030,681 | $197,270 |

| Freehold | Barstool | PlayUp | $6,969,453 | $6,780,699 | $188,754 | $921,060 | $176,401 |

| Monmouth Park | Caesars | SugarHouse | theScore | $4,542,182 | $3,092,389 | $1,449,793 | $525,040 | $95,402 |

| Tropicana | Caesars | $2,226,743 | $2,089,212 | $137,531 | $283,287 | $53,949 |

| Hard Rock | Hard Rock | bet365 | Unibet | $1,029,292 | $917,007 | $112,285 | $128,755 | $24,329 |

| Caesars | Caesars | 888 | Wynn | $631,641 | $446,124 | $185,517 | $73,765 | $13,472 |

| Ocean | Caesars | Tipico | $415,121 | $284,834 | $130,287 | $48,201 | $8,764 |

| Bally’s | N/A | $162,945 | $0 | $162,945 | $13,850 | $2,037 |

| Golden Nugget | Golden Nugget | BetAmerica | Betway | $138,547 | $54,659 | $83,888 | $14,236 | $2,415 |

| Harrah’s | N/A | -$67,076 | $0 | -$67,076 | -$5,680 | -$835 |

| Total | $84,152,035 | $76,951,970 | $7,200,065 | $10,643,178 | $2,019,072 |

Nitpicking Portnoy

For Portnoy’s quoted graph to be factual, 100% of internet sports betting revenue reported by a licensee would have to come from a single operator.

For example, all Meadowlands revenue would come from FanDuel, which means PointsBet and SuperBook generate $0.

Same for Resorts Digital with DraftKings generating all the revenue and nada from FoxBET.

In the case of Freehold, it would mean PlayUp Sportsbook contributed nothing in October while Barstool Sportsbook did all the heavy lifting.

While anything is possible, those scenarios are unlikely.

Barstool Sportsbook is for real

However, that does not wholly discredit Portnoy’s point.

This is where past performance and extrapolating data come into play.

The “Big Four” (FanDuel, DraftKings, BetMGM, Caesars) all launched mobile sports betting apps in 2018, claiming early market share. As additional skins were added by their respective licensees, those early percentages have not dramatically changed.

While inexact, this indicates that those specific operators account for the lion’s share of licensee reported revenue. Play NJ’s understanding, based on prior conversations with gaming executives, industry experts, and state gaming regulators, is that FanDuel, DraftKings, BetMGM and Caesars fit that description.

Looking at Freehold’s internet sports betting revenue reports since August, it would appear Barstool Sportsbook does as well. Freehold added PlayUp in September.

Barstool Sportsbook crashing the party

There are 22 online sports betting options in NJ. However, only a handful of apps are controlling the market.

FanDuel and DraftKings have been the undisputed No. 1 and No. 2 for nearly three years. Both operators individually generate more monthly online sports betting revenue than all nine Atlantic City casino retail sportsbooks combined.

BetMGM and Caesars (formally William Hill US) also hold a significant market share, but their combined monthly reports are often less than the top two.

Barstool Sportsbook has staked a claim to that top tier of NJ online sports betting operators.

The Stoolies have arrived in the Garden State

So, what does that all mean?

Well, it means that Barstool Sportsbook has made a dent in the ultra-competitive and increasingly crowded online sports betting market in NJ. But exactly how much is known only to state gaming regulators.

Sure, a particular sportsbook operator may be on the losing side some months when gamblers have some luck.

And, yes, it is believed that the big-name operators are responsible for the bulk of their respective licensee’s reported revenue.

With that being said, Barstool Sportsbook could have grabbed an 8.8% market share last month.

But it’s a safer bet to simply say that 2021 was the year Barstool Sportsbook put the NJ online sports betting market on notice.

The Stoolies are here.